Shared Ownership

The Shared Ownership Scheme allows you to purchase an agreed percentage of your new home, usually from 25% to 75% and pay rent on the remaining share.

What is Shared Ownership?

Shared Ownership provides an affordable way to buy a property. Simply purchase a share in a brand-new home and pay a subsidised rent on the remaining. In the future, if you wish, you can usually buy further shares until you own your home outright.

The initial share you buy will usually be between 25% and 75% of the full purchase price and is tailored to suit your circumstances, meaning it is not only affordable for you now, but in the future too.

A variety of Shared Ownership properties may be available from studio apartments right through to large family homes.

The benefits of Shared Ownership

- A more affordable way to get on the property ladder

- Lower deposits than what you would need for a market sale purchase

- Mortgages tend to be more accessible, even if you are on a lower wage

- Mortgage approvals tend to be higher due to the lower risk and lower amount required

- Monthly repayments are typically cheaper than if you had an outright mortgage

- The option to buy more shares in the future - a process known as 'staircasing'

- Shares can be sold at any time after the initial year of purchase

How does Shared Ownership work?

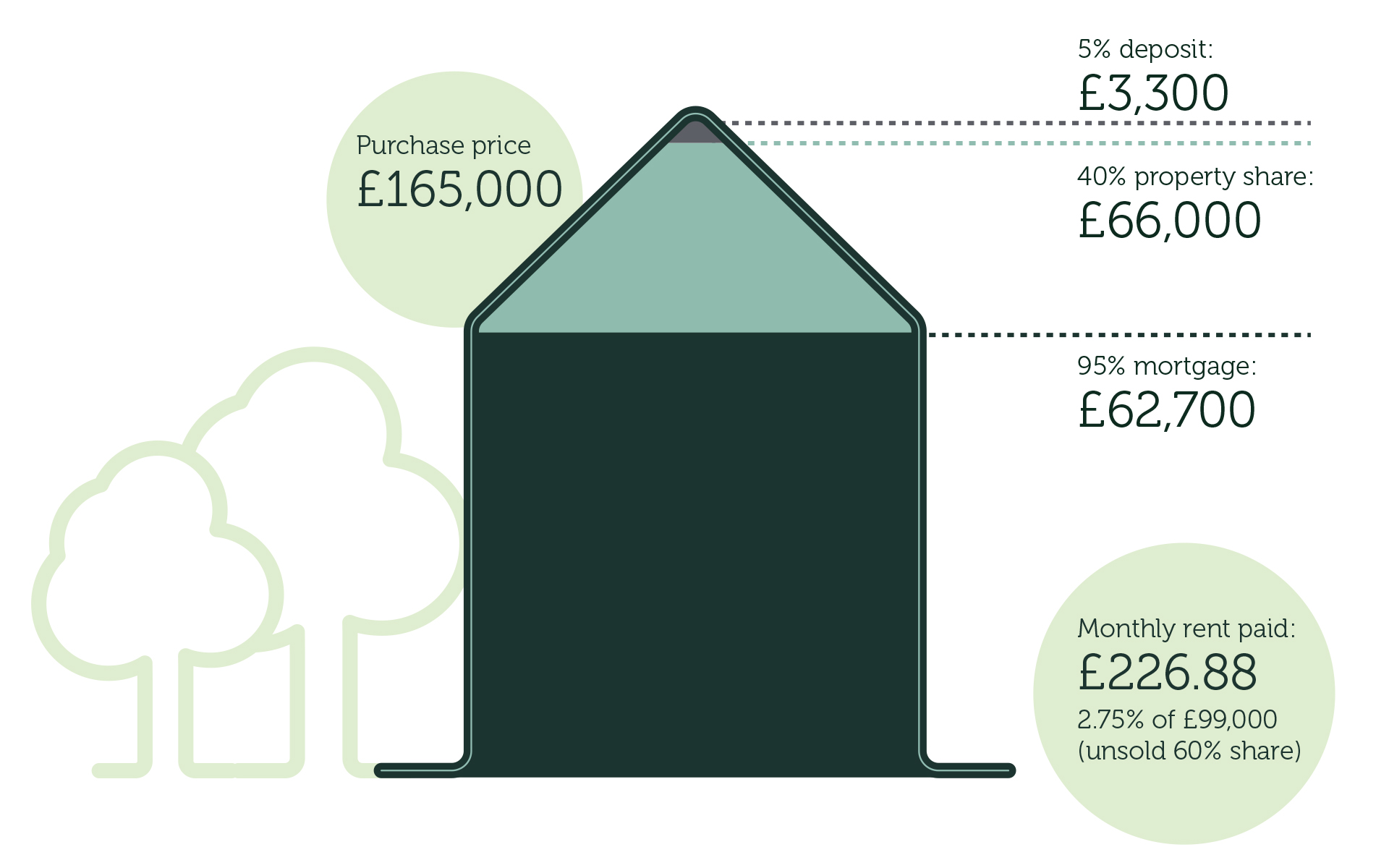

Here is an example of Shared Ownership price breakdown based on a house value of £165,000 with a 40% share.

The good news here is you only pay a deposit on the percentage you are buying e.g. 25%, 50% or 75%...and so you’ll need a much smaller deposit, than if you were buying 100% of the property.

There are also extra costs when buying a home. This includes solicitors’ fees and mortgage arrangement fees and typically costs about £1,000.

Shared Ownership eligibility

You may be eligible for Shared Ownership if:

- You are over 18 years old

- You are not a homeowner

- You are in possession of a good credit record

- You are able to afford the payments for your share

Priority for Shared Ownership is given in the following order:

- Existing Social Housing Tenants and MOD Personnel Local Priorities as set by the Local Authority (these may vary from development to development)

- Other first time buyers

- Although Shared Ownership is usually aimed at first time buyers, applications from non-first time buyers may also be considered in some circumstances

Search for Shared Ownership homes near you

How does Shared Ownership work?

FAQs

Staircasing is the term given to buying extra shares in your Shared Ownership property.

Shared owners may increase the percentage share of the equity that they own at any time during the term of the Shared Ownership lease.

You can usually buy in 1% increments or in chunks of 10%+ at a time.

If you are considering staircasing, you will need to find out from your lender whether they are willing to lend you a further amount.

Yes. A maximum of four people can become joint owners on a Shared Ownership property. But this would need to be discussed with your solicitor.

As a home owner you will be responsible. If you are buying a new build property, you should undertake a snagging survey, this is in place to check for problems and issues that may arise with a new build home and these problems should be resolved by the developers before you move in. Additionally, you usually have a guarantee of at least 2 years for these kinds of things.

Of course! But if you’re thinking of making structural changes you must check the terms of your lease and you may need to get permission before any changes are made.

That’s a plain and simple no, and also one of the most common myths about Shared Ownership. You own a share of a property and the other share is owned by the developer, not another individual.

You’re the only one who lives there, except from family you may live with.

Assignment is the term given when you sell your Shared Ownership lease.

When you sell your Shared Ownership lease, the purchaser is agreeing to take on the terms and conditions within the lease. This transfer of responsibilities from one party to another is the ‘assignment’.

You can only sell your share of the lease. For example, if you own a 50% share, then you can only sell 50%.

Find out more about Selling/Assigning your Shared Ownership lease here.

If you have purchased your home with the aid of a HomeBuy loan or a Shared Ownership lease, and you think of selling your property or extending your lease, there are some Additional Charges that may apply.

In addition to repaying a mortgage on the part of the Shared Ownership property that you own, you will also need to pay subsidised rent.

This is usually between 2.5% and 2.75% on the other share.

If you staircase up (increase the share that you own) all the way up to 100%, then you will no longer pay rent, as you will own all of the Shared Ownership property.

You can make a profit on your share if the value of your home increases since you bought your shares.

House prices can however fall as well as rise, so it’s important to be aware of changes in the housing market.

No, it is usually not permitted for a Shared Ownership homeowner to be able to rent out their home.

This information will be found on your lease when you buy a Shared Ownership home.

Shared Ownership is very popular with first-time buyers for being an affordable way to get onto the property ladder, but anyone who meets the Shared Ownership eligibility criteria can potentially purchase a home through Shared Ownership.

If the property value is lower than the Stamp Duty threshold of £250,000, then you will not need to pay any Stamp Duty when purchasing your home.

If you are a first time buyer and the property is below £625,000 then you may be able to claim First Time Buyers Relief, which means you won’t pay any Stamp Duty on the first £425,000 of the property, and only 5% on the remainder.

If you are not a first-time buyer, you will pay 5% Stamp Duty on properties if the value is more than £250,000.

You only need to pay Stamp Duty when buying the home if your share is valued above the threshold.

If you buy more shares in the property through ‘staircasing’ in the future, then Stamp Duty may come into effect.

Depending on the specific development, you will be able to buy a share of a Shared Ownership property usually between 25% and 75%.

With ‘staircasing’, you can also increase the share that you own over time.

Yes you can. This is commonly known as staircasing in Shared Ownership.

You can usually buy in single 1% increments or in chunks of 10%+ at a time.

This is something that many Shared Ownership home owners do as their financial situation improves over time.

Yes, all homes Shared Ownership homes are sold as leasehold.

This means that the buyer is given the right to live in the property for a set number of years, but the land itself belongs to the freeholder, which will be the housing developer or housing association.

The lease is a contract between the freeholder (the housing developer or housing association) and the leaseholder (the purchaser).

Yes, all homes Shared Ownership homes are sold as leasehold.

This means that the buyer is given the right to live in the property for a set number of years, but the land itself belongs to the freeholder, which will be the housing developer or housing association.

The lease is a contract between the freeholder (the housing developer or housing association) and the leaseholder (the purchaser).

Before applying for a Shared Ownership property, you should check that you are eligible and make sure that you have enough money saved for a deposit and other essential home buying costs.

You should also check that you are able to borrow enough with a mortgage to pay for the share in the property you are interested in.

The next step is to find a Shared Ownership property near you.

You can then register your interest in that development or property and one of the Orbit Homes team will get in touch with you to discuss the property further.

This will include some eligibility and affordability checks too.